Digital Marketing Strategy for Manufacturing Industry in Recession

Tl;dr - Marketing is marketing. Marketing is sales. Sales is sales. Sound convoluted? Maybe, but it's critical to understand to prepare your business now for revenue growth during the recession ahead.

Typical Industrial Manufacturer Reaction to a Recession

We've all seen this movie before. Machinery builders with order books still pretty full from activity as a market peaked are busy concentrating on building and delivering.

But suddenly in the background inquiries evaporate. That gets some notice, but not much, because there are higher priorities. There are projects to finish, and after all the pipeline still looks pretty good...chock full of projects that sales say are sure to close.

Those opportunities melt away.

Recognized revenue remains high as machines continue to ship, but bookings (and cash from progress payments) crash.

Suddenly there's a rush to slash expenses. R&D may take a hit, travel expenses get trimmed, vendor payments are slowed, and.....industrial marketing gets slashed.

Of course, there's not much fat there to cut since it's mostly just trade shows and magazine ads. But it's something, and things feel desperate.

Because this is the playbook that most industrial company execs have turned to in the past, it's their go-to motion when a recession hits.

Except....

It might have never been the most sensible approach (to cut back on growth when you most need to grow) but today it's disastrous.

There was a time when marketing just created a few leads, did some branding, organized trade shows, and coordinated printing of data sheets. Scaling those functions back might have seemed reasonable.

Today, however, marketing does (or should be doing) a substantial portion of your sales.

Marketing is Now Sales - Be Careful Where

You Cut!

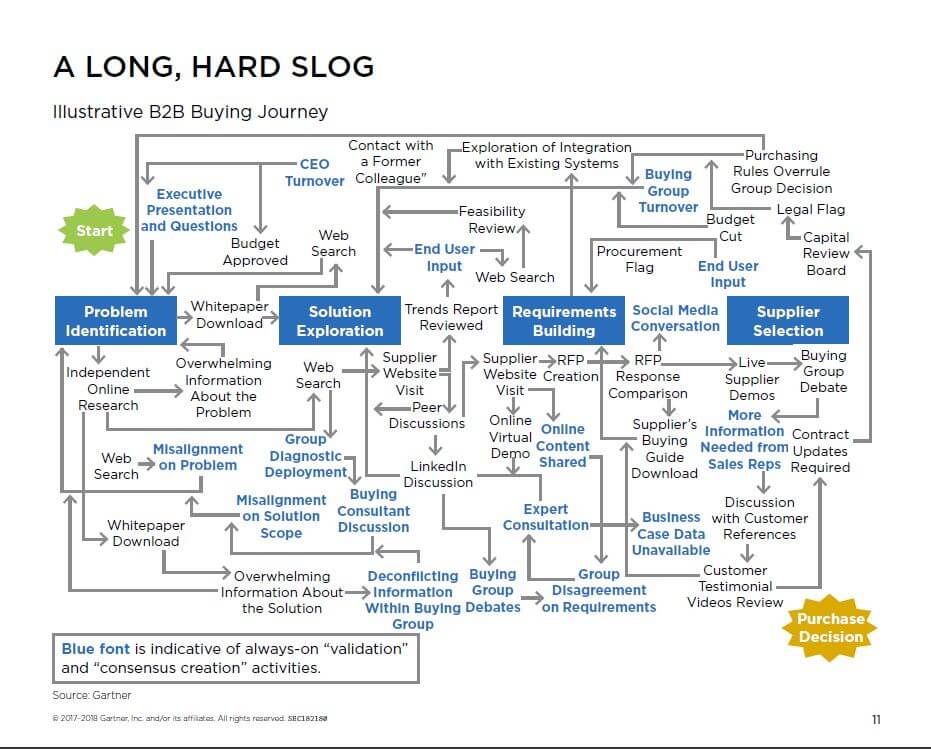

You've probably seen CEB's version of Gartner's buying journey graphic1. I challenge you to identify a demarcation point between marketing and sales.

You've probably seen CEB's version of Gartner's buying journey graphic1. I challenge you to identify a demarcation point between marketing and sales.

There isn't one. So where's the line to cut from?

In fact, the journey bounces back and forth between marketing and sales.

While many industrial companies haven't yet built the staff, content, and infrastructure to fully address this, nevertheless this is buyers' expectation.

So instead of cutting the marketing budget in the future when the recession begins to bite, the more prudent approach is to allocate funds now and begin the work necessary to support buying journeys with a robust industrial inbound marketing program.

Improve Customer and Market Strategy

Boosting marketing spending (since good marketing is also selling today) is a much better plan than slashing marketing. And doing it now while you still have orders in process is sensible.

But who are you going to target?

It's going to be especially important in a tough market to target the right buyers with solutions to solve the pressing problems they'll experience in that same market environment.

Most middle-market manufacturers can't do that precisely. They've targeted certain verticals in some cases, and responded to inquiries in most.

It's time to get quite precise in defining your ICP (ideal customer profile) to include factors such as:

Then engage a 3rd party to research the real business problems you solve, and which of those are likely to be most pressing in a downturn. Be sure to quantify the typical dollar value of solving those problems, and develop some detailed competitive intelligence.

Take that research and build content and messaging around those issues - now! Start to populate your website, optimize SEO and train your sales team on discussing those issues. This strategy work will inform your content marketing and sales preparations.

Developing this laser focus may feel counterintuitive. You might assume that when orders tighten you want to cast as wide a net as possible. That's generally not correct. Finding the deals that are closeable and resistant to discounting will require you to be very particular about identifying the right prospect profile.

Optimize Your Sales Talent, Structure & Recruiting

As much as marketing fills traditional sales functions, sales is still critical to success.

Recessions are a notoriously tough time for sales teams as warts previously masked by strong economic activity become obvious.

So, instead of waiting for the market, prospects and competitors to uncover weaknesses, take this time to find and fix them yourself, proactively.

Here are the steps you should take.

None of these steps are difficult, expensive or particularly time-consuming. The biggest barrier will be your mindset which tells you pull back into your shell as recession looms.

But NOW is the time to prepare. Get started.

Doing More with Less - Conserving Budget While Boosting Results

None of this ignores the fact that as the recession deepens you're going to have conversations about how to cut costs and conserve cash. That's normal and sensible (of course we should have those same conversations during booms too!)

Here are some specific ideas that you can also start to work on now that will position you for savings later.

Let's look at each in a bit more detail.

Marketing to support sales - As noted earlier in this article, traditional marketing functions are increasingly active in creating sales opportunities and helping to advance them through stages in the pipeline. This isn't a replacement for sales; sales isn't going away. BUT, instead of a team of two marketers and 25 sales (common in a middle-market machinery scenario) you might have five in marketing, 2 in inside sales, and 14 or 15 in sales - a 22% reduction in headcount.

The opportunity ranges from large to small. On the large end, content marketing campaigns focused on the problems recession creates for your ICP can be a great top-of-the-funnel lead generation tool. Marketing can help nurture leads until their sales-ready and supplement your sales team's prospecting. They can add efficiency in incrementally small ways too that will aggregate to larger efficiencies. Imagine a host of email templates, created by marketing copywriters and A/B tested and refined, that save your sales team time with each prospect touch.

Technology to boost efficiency - You'll need every prospect and customer interaction, every sales rep activity, and every dollar spent on marketing to deliver maximum effect. Technology can support this. Certainly, there's a cost to technology, and it may seem startling because you haven't traditionally spent much. (Find some tips on budgeting here.) And you may have invested in technology before that was never fully implemented. That's a legitimate concern. It's also one of the categories of skills that you need to consider when evaluating your sales team. You need people who will value and maximize the tools you provide.

Properly designed and implemented, technology will boost each reps efficiency and effectiveness. You'll have much accurate and timely insights into pipeline, forecasts, rep productivity, marketing ROI and more.

You should plan on at least marketing automation, CRM, optimized CMS, sales force automation/sales acceleration, sales video and chat.

Optimize the sales team - Only about 50% of sales makes quota even in strong markets. You can't afford to carry deadweight during a downturn. There's a direct cost (compensation and benefits) and an opportunity cost (deals that actually do happen that you miss because of sales mediocrity) to weak sales, particularly during a recession.

So it's critical to know who WILL sell so that you can give proper training and coaching to those on the bubble, and know who you need to find other roles for when it's time to cut headcount.

Get a headstart today with an innovative SmartSizing™ Tool. The tool will help you run scenarios to support different degrees of sales force reduction. It considers factors including selling skills relevant to a recessionary market environment (price resistance, creating urgency, selling consultative, ability to sell remotely and with limited supervision, etc.), rep's current performance against quota, current revenue, and current carrying cost. It compares their fit to their current role with other roles on your sales team (put the right people in the right seats) and the quality of their pipeline.

In short, it helps you visualize which members of your team will be the ones to carry you through the recession while growing sales, and lets you run lots of "what if" scenarios.

Intrigued? Check out a live on-line sample by completing the form below.

This content was originally published here.